is maine tax friendly to retirees

AL has state taxes ranging from 4 - 75 and property taxes that are some. Is Maine Tax Friendly To Retirees.

Which States Are Best For Retirement Financial Samurai

Low property tax is especially important for.

. Three main types of state taxesincome tax property tax and sales taxinteract to determine the most tax-friendly states if youre retired or youre about to. Permanently exempted groceries from the state sales tax in 2022. 1902 per 100000 of assessed home value.

Social Security is exempt from taxation in. By Benjamin Yates August 15 2022. The state income tax is very low starting at 3 percent and stands out as a.

The higher income tax can be a. It fully exempts Social Security retirement benefits and income from public. Social Security income is not taxed.

Social Security income is not taxed. One of the most significant downsides of retiring in Maine is the states high-income tax with a retirement income tax as high as 715. Social Security income is not taxed.

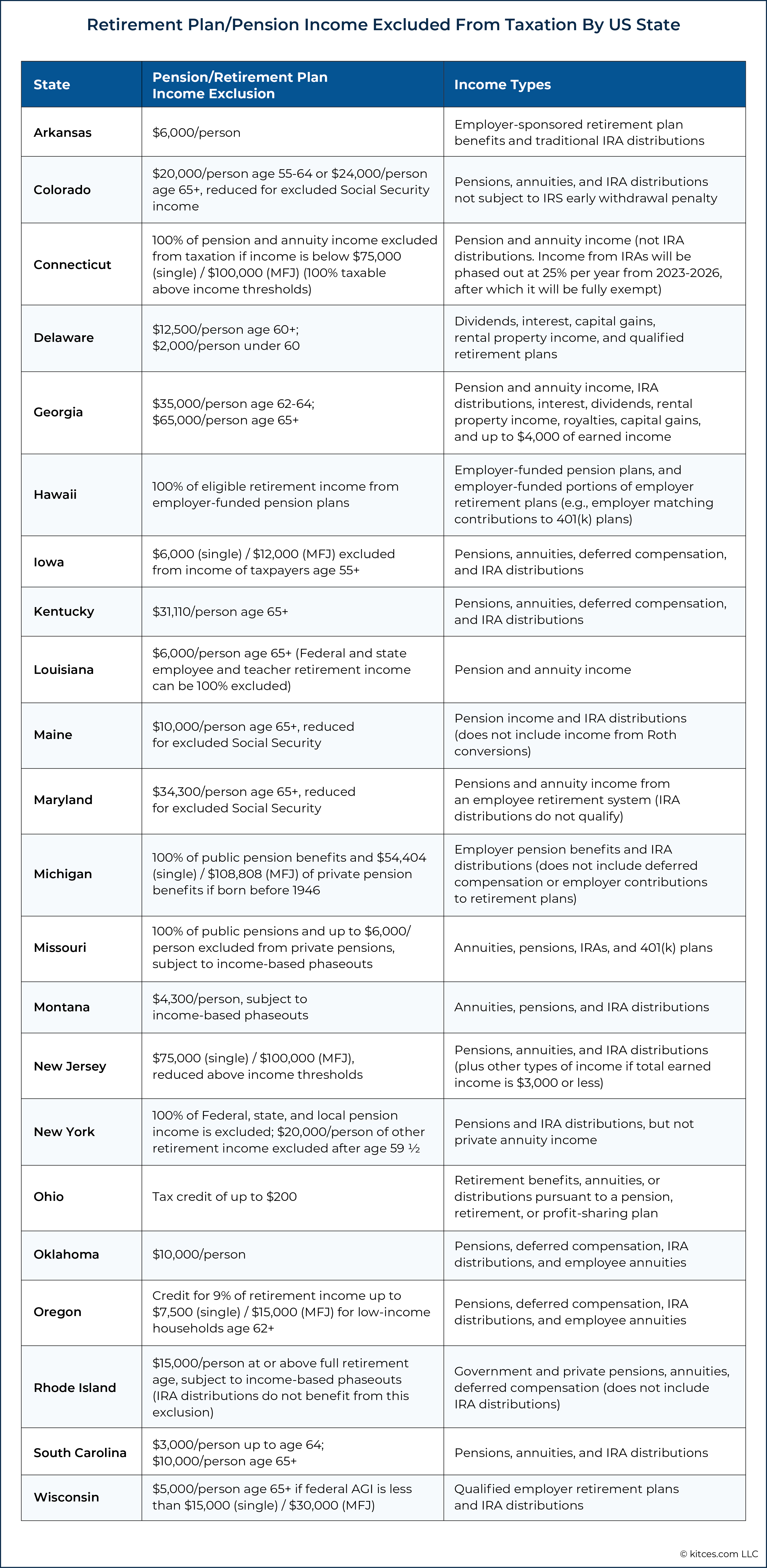

Tax friendly states charge fewer taxes that might apply to retirees like income tax capital gains tax property tax and sales tax. Withdrawals from retirement accounts are partially taxed. The number of recreation centers and retirement communities per 1000 residents were also considered as well as the percentage of each citys population made up of senior.

Massachusetts is moderately tax-friendly for retirees. Average property tax 607 per 100000 of assessed value 2. Is maine a tax friendly state for retirees.

Established a 39 flat income tax rate and eliminated state tax on retirement income in 2022. Wages are taxed at normal rates. Other retirement income is taxed as regular income ranging from 2 to 5.

Maine with a tax burden of just over 10 is. Wages are taxed at normal rates and your marginal. Is maine a tax friendly state for retirees.

Maine is not tax-friendly toward retirees. Withdrawals from retirement accounts are fully taxed. Maine Retirement Tax Friendliness Smartasset Is Maine tax.

Luckily while you have to watch out for the maine state income tax your. Ohio is moderately tax-friendly toward retirees. 127 of home value.

Maine Retirement Tax Friendliness Smartasset Is Maine tax-friendly for retirees. Luckily while you have to watch out for the maine state income. Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly opens in new tab and the 10 least tax-friendly states.

Best Retirement States New Hampshire Colorado Maine Top New List

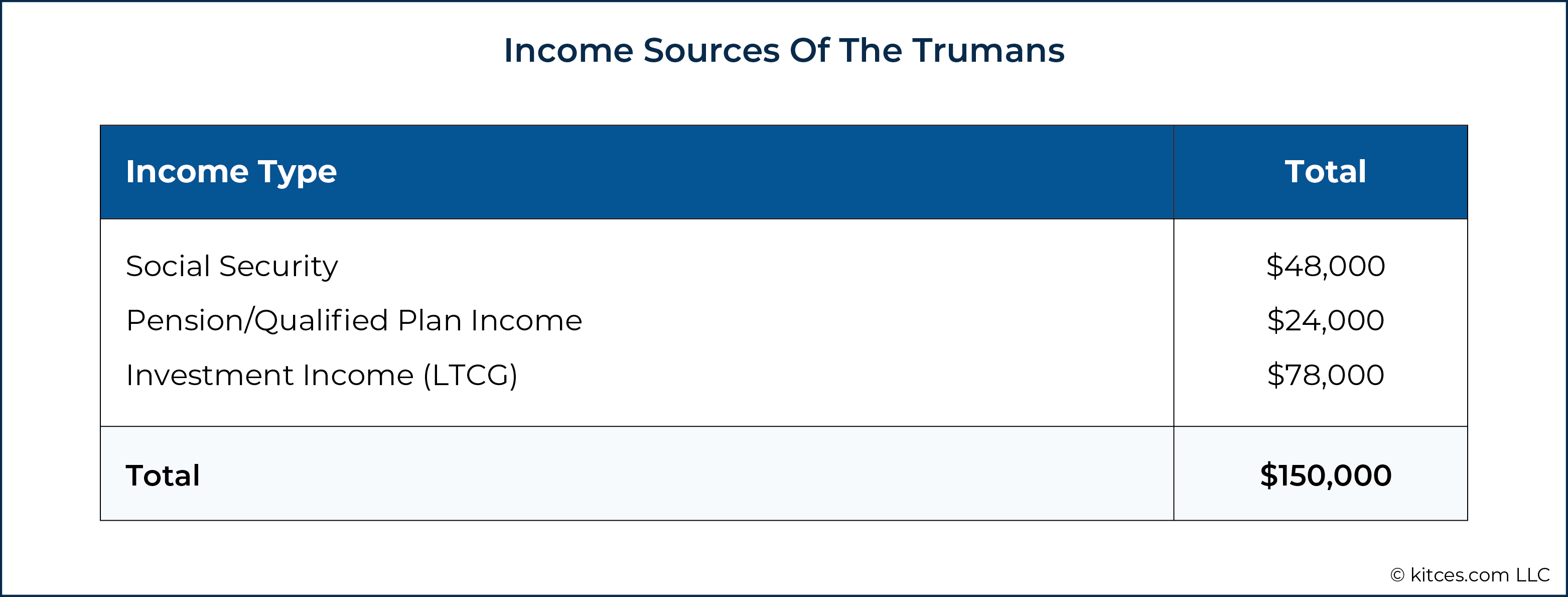

How To Determine The Most Tax Friendly States For Retirees

States That Don T Tax Military Retirement Pay Discover Here

10 Affordable Small Towns In Tax Friendly States Retirement Benefitspro

Best And Worst States For Retirement Retirement Living

The 37 States That Don T Tax Social Security Benefits The Motley Fool

Reasons To Retire In Maine Cumberland Crossing By Oceanview

State By State Comparison Where Should You Retire

State By State Comparison Where Should You Retire

The Best States To Retire For Taxes Smartasset

Maine State Tax Guide Kiplinger

Which State Is The Most Exciting To Retire To Sixty And Me

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

Maine Retirement Taxes And Economic Factors To Consider

Wisconsin Losing Ground To Tax Friendly Peers Tax Foundation

How To Determine The Most Tax Friendly States For Retirees

Best States To Retire Madison Wealth Management